Parimatch Wire Transfer Withdrawal Australia – How to Cash Out Smoothly

Learn what affects Parimatch wire transfer withdrawals in Australia, including timing, fees, and how to avoid delays for smooth, secure cashouts.

You can withdraw your Parimatch winnings directly to your Australian bank account through a wire transfer, but it’s not instant — the funds usually take a few business days to arrive because they move through international banking networks.

This method is most useful when you’re cashing out larger amounts or prefer money sent straight to your bank rather than through e-wallets.

For Australian players using options like Parimatch wire transfer withdrawal Australia, the process involves verifying your account, entering your bank details accurately, and waiting for both Parimatch and your bank to process the transaction.

In the rest of this article, you’ll learn how the transfer works step by step, what delays or fees to expect, and how to make sure your withdrawal goes through without issues.

How Parimatch wire transfer withdrawal Australia works

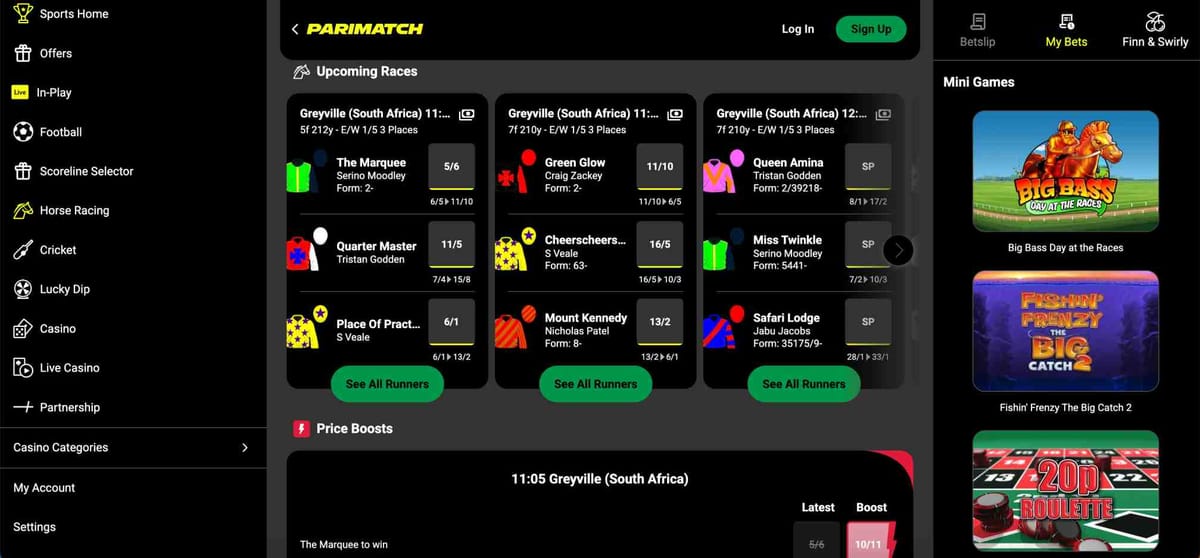

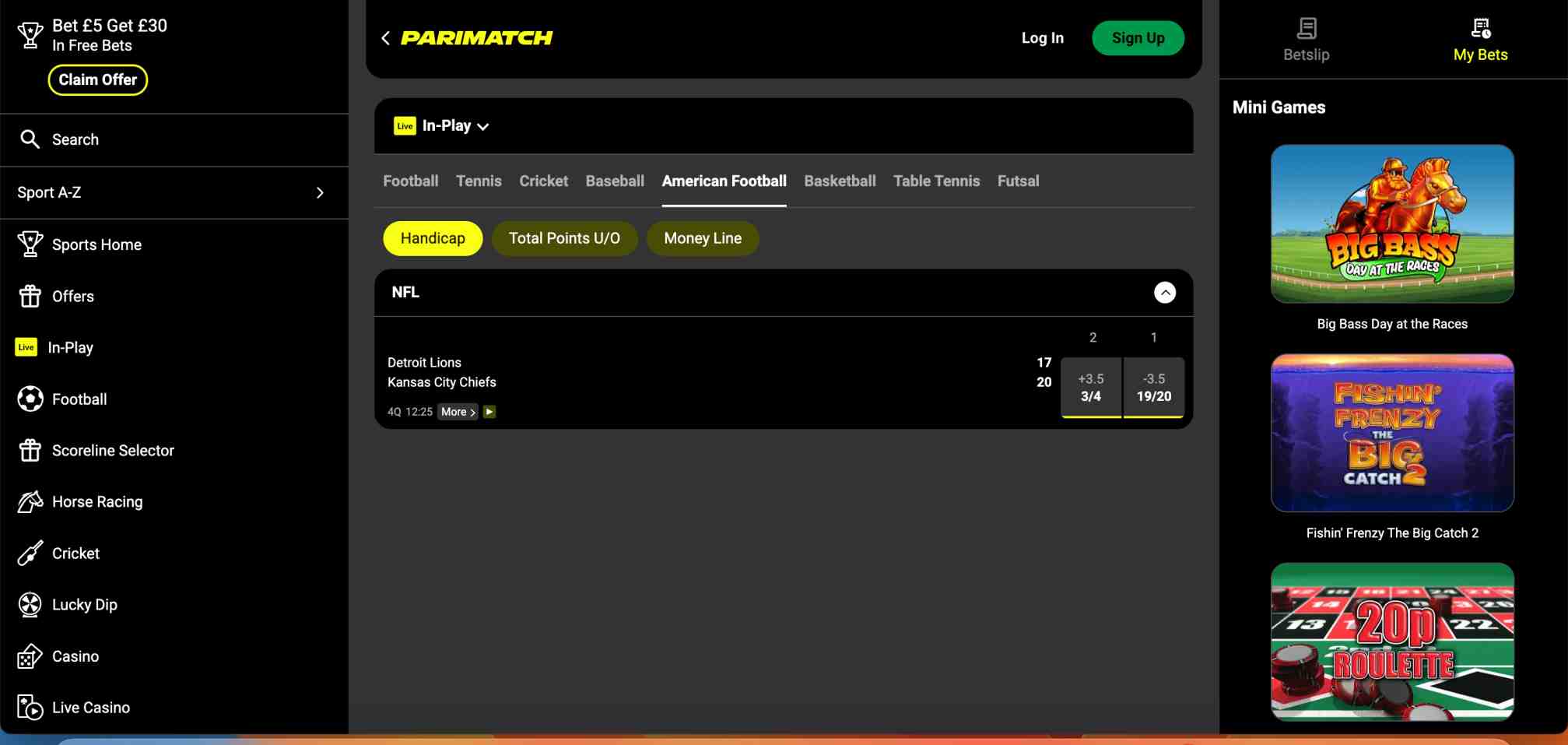

Parimatch’s banking options adjust depending on where your account is registered and how you first deposited — for instance, players can check can you deposit to Parimatch with Revolut to see if that method is supported in their region.

For Australian players, the wire transfer method shows up in your withdrawal menu once your account is verified and your bank supports international transfers.

When you select this method, Parimatch will ask for your full bank account details — your account name, BSB or SWIFT code, account number, and the bank’s name.

Once you confirm, the funds are sent directly through Parimatch’s international payment processor.

Because it’s a traditional wire transfer, the money doesn’t move instantly — it travels through a network of correspondent banks before reaching your Australian bank.

This method is secure and widely trusted, but it’s not as fast as options like Skrill or Neteller. That’s the trade-off most people weigh before using it.

Processing times for Parimatch wire transfer withdrawal

From what I’ve seen, the processing time for a Parimatch wire transfer withdrawal in Australia can range from three to seven business days.

Parimatch usually takes one to two days to approve and send the funds, then your bank’s internal systems handle the rest.

The delay isn’t usually Parimatch’s fault — it’s the way international wires are routed through multiple banking partners. If the withdrawal was made on a Friday or before a public holiday, it might take an extra day or two.

I always recommend checking your email after submitting the request. Parimatch normally sends a confirmation once the transfer is initiated, which means it has left their side and is now being processed by your bank.

Fees and currency conversion to know about

One thing many players overlook is the potential for bank and conversion fees. Parimatch generally doesn’t charge for withdrawals, but when you use wire transfer, there are a few costs that might apply:

- Your Australian bank may charge a small incoming wire fee.

- Intermediary banks (the ones routing the funds) sometimes take a service charge.

- If your Parimatch balance is in USD or EUR, your bank will automatically convert the funds to AUD at their own exchange rate.

In my experience, these deductions are small but noticeable — usually a few dollars per transaction. To avoid surprises, it helps to check with your bank about their wire transfer fees and rates before you withdraw.

How to request a Parimatch wire transfer withdrawal

The process is straightforward once your account is verified.

Here’s how it goes in practice:

- Log in to your Parimatch account.

- Go to “Wallet” or “Finance.”

- Click “Withdraw.”

- Choose “Bank Transfer” or “Wire Transfer” from the list.

- Enter your withdrawal amount and bank details exactly as shown on your statement.

- Confirm and submit your request.

In my experience, the most common reason a withdrawal gets delayed is incomplete verification.

If you haven’t submitted your ID or proof of address, Parimatch will pause the transaction until it’s approved. Doing this ahead of time can save days of waiting.

Common issues with Parimatch wire transfer withdrawals

While the process is reliable, there are a few recurring issues that players in Australia run into.

The first is missing or mismatched details — even a small typo in your account name or SWIFT code can cause a rejection. Always double-check before submitting.

Another common problem is that wire transfer doesn’t appear as a withdrawal option. This usually happens when your initial deposit was made via an e-wallet or prepaid card.

Parimatch’s policy is to send withdrawals back through the same payment route when possible, to comply with anti-fraud regulations.

If you want to switch to wire transfer, you’ll need to contact support and confirm your banking details manually.

Finally, there’s the occasional issue of delays on the receiving bank’s end. Some Australian banks take extra time to process incoming international wires, especially from gaming platforms.

In that case, Parimatch support can provide the transfer reference number so your bank can locate the funds faster.

Alternatives to wire transfer for faster withdrawals

If waiting several days for a wire transfer doesn’t suit you, you might prefer quicker methods like e-wallets or other payment types — for example, learning does Parimatch accept Google Pay can help you choose a faster option available in Australia.

E-wallets like Skrill, Neteller, or Jeton typically complete withdrawals within 24 hours. Debit and credit card refunds can also be quicker, though they may have smaller limits.

That said, wire transfers still have one big advantage: they’re ideal for large withdrawals. If you’re cashing out a big win and prefer to move funds directly into your bank with full traceability, wire transfer is the safest route.

Final thoughts on Parimatch wire transfer withdrawal in Australia

Overall, a Parimatch wire transfer withdrawal in Australia is a secure and reliable way to access your winnings — it just requires a little patience.

It’s best suited for players withdrawing higher amounts or who prefer direct bank transfers over digital wallets.

In my experience, the process runs smoothly as long as your identity is verified, your bank details are accurate, and you allow enough time for international processing.

If your withdrawal seems stuck or delayed, Parimatch’s live chat support is responsive and can check your transfer status directly with their payments team.

If you’re after the fastest possible payout, you might want to combine wire transfers for big withdrawals with e-wallets for smaller, everyday cashouts. That balance gives you both speed and peace of mind.

FAQs

How long does a Parimatch wire transfer withdrawal take in Australia?

A Parimatch wire transfer withdrawal in Australia usually takes three to seven business days, depending on bank processing times and public holidays.

Does Parimatch charge fees for wire transfer withdrawals?

Parimatch itself doesn’t charge withdrawal fees, but Australian banks and intermediary banks may apply small incoming or conversion fees.

Why isn’t wire transfer showing as a withdrawal option on Parimatch?

If wire transfer doesn’t appear, it’s often because your initial deposit was made through a different payment method like an e-wallet or card, which Parimatch prioritizes for withdrawals.

How can I avoid delays with my Parimatch bank withdrawal?

Make sure your account is fully verified, your banking details are accurate, and you’ve submitted all required identification before requesting a withdrawal.

What’s the best alternative to Parimatch wire transfer withdrawals in Australia?

E-wallets like Skrill or Neteller are the fastest alternatives for Australian players, often completing withdrawals within 24 hours.