Does Parimatch Require KYC? A Complete Guide to Verification & Withdrawals

Learn how Parimatch’s verification works, what documents you’ll need, and simple ways to speed up approval so you can withdraw without hassle.

Before you can withdraw your winnings or fully unlock your Parimatch account, you’ll need to complete a quick identity verification process that confirms who you are and ensures your funds come from legitimate sources.

This step helps Parimatch comply with gambling regulations, prevent fraud, and keep every player’s account secure.

Many new users come across questions like does Parimatch require KYC when they try to make their first withdrawal, not realizing it’s a standard requirement for licensed sportsbooks.

The good news is that the process is usually fast and straightforward if your documents are valid and clearly uploaded.

In this guide, we’ll walk through why KYC matters, how to submit your documents correctly, and a few easy ways to avoid delays in getting verified.

Why Parimatch requires KYC and does Parimatch require KYC

Parimatch, like most regulated sportsbooks, uses KYC to confirm that each player is a real person over the legal gambling age and that the funds being used come from legitimate sources.

This isn’t unique to Parimatch — every serious bookmaker that follows licensing rules has similar checks.

The purpose of KYC at Parimatch is twofold: to protect your account from fraud and to comply with anti-money-laundering regulations. Essentially, it’s Parimatch’s way of keeping the platform safe and ensuring fair play for all bettors.

In my experience, KYC also helps prevent issues down the road.

Many players skip verification at sign-up, only to find they can’t withdraw their winnings later because their ID hasn’t been approved. It’s always best to handle KYC early — ideally right after registering.

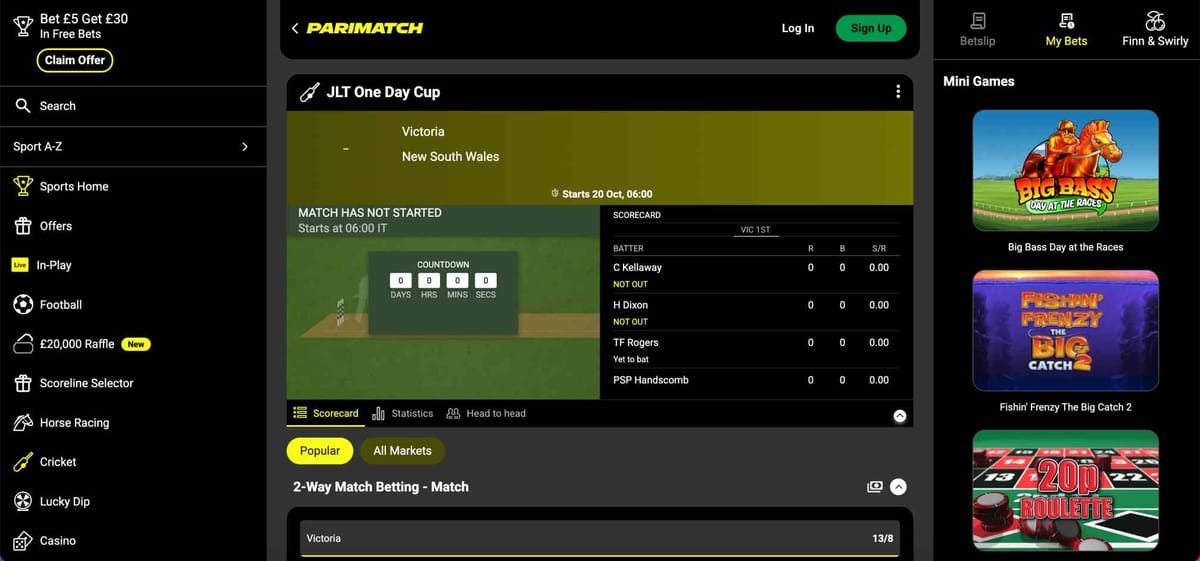

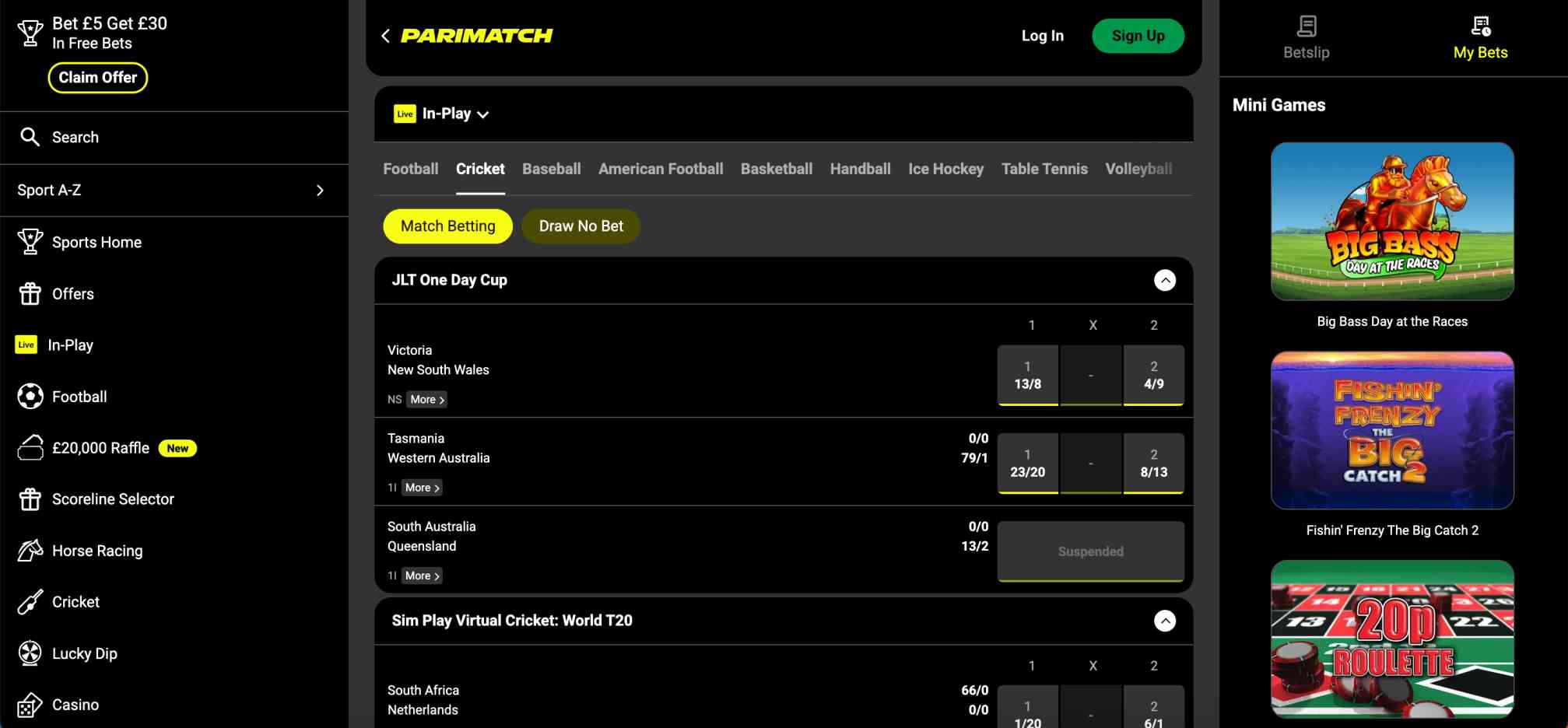

How the Parimatch KYC process works

Once you sign up and make your first deposit, Parimatch may prompt you to verify your account. This usually happens when you request a withdrawal for the first time, or if your total deposits reach a certain threshold.

Here’s what typically happens: you’ll receive a notification in your account profile or an email asking you to submit identity documents.

Parimatch usually asks for:

- A government-issued photo ID (passport, driver’s license, or national ID card)

- Proof of address (utility bill, bank statement, or any official document showing your name and address)

Sometimes, depending on your country or payment method, they might also request a selfie or video verification to confirm that you’re the same person as on the ID.

In my experience, uploads through Parimatch’s verification portal are processed within 24 to 48 hours, though it can take longer if the images are blurry or incomplete.

Always double-check that your documents are valid, clear, and match the details you used when registering.

When Parimatch might ask for additional checks

It’s not uncommon for Parimatch to request an extra layer of verification, especially for large withdrawals or when you change your payment method.

I’ve seen cases where users were asked to confirm ownership of the card or e-wallet they used for deposits.

This isn’t meant to slow you down — it’s simply Parimatch’s compliance team following security protocols. If you ever get a message asking for “source of funds” documentation, don’t panic.

This usually means they need to confirm that your betting activity aligns with responsible gaming policies. Submitting recent payslips or bank statements usually clears it up quickly.

What happens if you don’t complete KYC on Parimatch

If you skip KYC verification, you can still browse odds and even place bets, but you won’t be able to withdraw any winnings or resolve issues like when a Parimatch accumulator bonus is not paid until your account is verified.

In some cases, Parimatch may freeze deposits or restrict betting limits until the documents are submitted.

I’ve also seen accounts temporarily suspended when users ignored verification emails for too long. So if you get a KYC prompt, handle it right away — it’s much easier than trying to fix access issues later.

Tips to speed up your Parimatch KYC approval

Here’s what I’ve learned works best for getting verified quickly on Parimatch:

- Use the same name and address on your ID, payment method, and Parimatch account.

- Make sure all photos are high-resolution and corners of the document are visible.

- Avoid cropping or editing files — send them as-is from your camera or scanner.

- If you’re unsure which document qualifies, reach out to Parimatch live chat first; their support agents are usually responsive and helpful.

These simple steps often mean your KYC gets approved in one go without any back-and-forth.

Can you bet on Parimatch before verification?

Yes, you can place bets before full KYC verification, but your withdrawal options will remain locked until you verify your identity. In my experience, casual bettors sometimes start without realizing this, then face a delay when trying to cash out.

If you’re planning to claim bonuses or withdraw early winnings, I’d strongly recommend completing KYC right after registering so you don’t face issues when trying to convert your Parimatch bonus into cash.

It ensures your account is ready when you need it and helps avoid payout delays.

Final thoughts on Parimatch and KYC requirements

So, does Parimatch require KYC? Absolutely — and for good reason. It’s there to protect both you and the platform. The process might feel like a formality, but it’s an essential part of responsible, licensed online betting.

Once you verify your account, everything runs smoothly: faster withdrawals, higher limits, and a fully secure betting experience.

From what I’ve seen, Parimatch’s KYC process is efficient compared to many other sportsbooks, as long as you provide accurate documents upfront.

If you ever run into issues or delays, the Parimatch support team is your best resource — just open a live chat from your account and they’ll walk you through what’s missing.

After that, you’re all set to focus on what really matters: finding great odds and enjoying your bets with peace of mind.

FAQs

Does Parimatch require KYC verification?

Yes, Parimatch requires KYC verification to confirm your identity and ensure your funds come from legitimate sources before you can withdraw winnings.

How long does Parimatch KYC verification take?

Most Parimatch KYC verifications are processed within 24 to 48 hours, as long as the documents are clear and match your account details.

Can I bet on Parimatch without completing KYC?

Yes, you can place bets before completing KYC, but you won’t be able to withdraw any winnings until your identity is fully verified.

What happens if I don’t complete KYC on Parimatch?

If you skip KYC, your account may face withdrawal restrictions or even temporary suspension until you provide valid documents.

Why does Parimatch ask for additional verification documents?

Parimatch may request extra verification for large withdrawals or when changing payment methods to comply with security and anti-fraud rules.