Are Betway Winnings Taxable in Canada? Complete Guide for Players

Understand how Canadian tax law views online betting payouts and when exceptions could apply for players with more structured gambling activity.

Most Canadians who place bets or play casino games online don’t have to pay tax on their winnings, because the government generally treats gambling as a matter of luck rather than a source of income.

This means casual players who place a few wagers for fun can usually enjoy their payouts without worrying about deductions or filing extra paperwork.

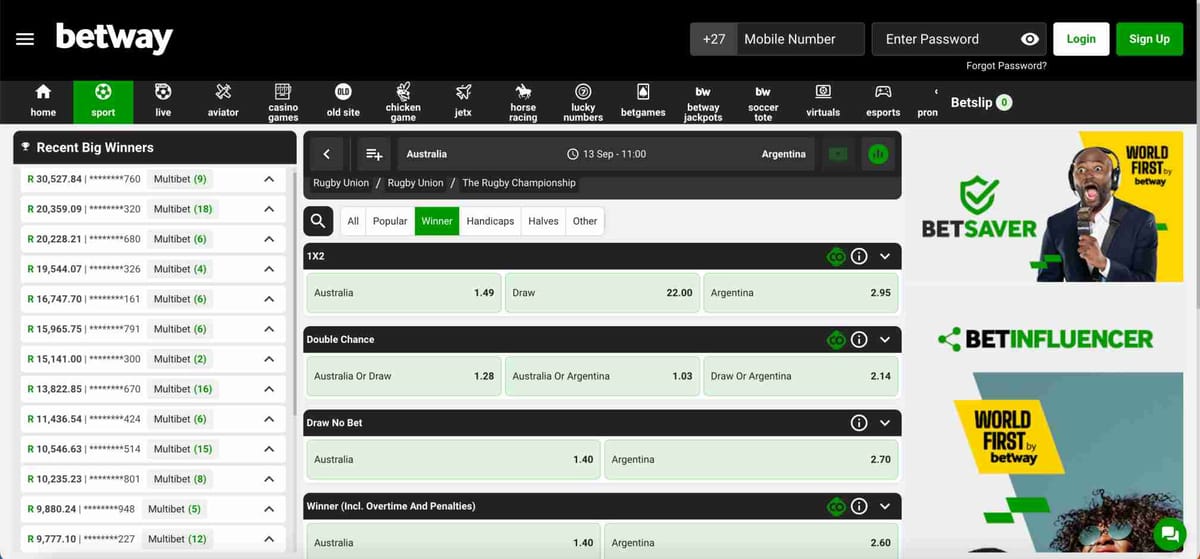

However, questions often come up around specific platforms, such as are Betway winnings taxable in Canada, especially when people start winning larger amounts or betting more frequently.

The rules can get more complicated if someone is gambling in a professional, business-like way, since the Canada Revenue Agency may see those profits differently.

In this article, we’ll break down how Betway payouts are treated under Canadian tax law, when exceptions might apply, and what you can do to stay on the safe side.

How Betway winnings are treated under Canadian law

Canada’s tax system is fairly straightforward when it comes to gambling. For the average person who places sports bets for fun, winnings are not considered taxable income.

That means if you place a wager on Betway and score a profit, you don’t need to declare it on your tax return, but it’s still worth knowing is Betway legal in Canada for international students if you’re studying or temporarily residing there.

This applies whether you cash out small bets or hit a rare, large parlay win.

The reasoning is that casual betting is considered a game of chance, not a reliable source of income. Since the Canada Revenue Agency (CRA) doesn’t view occasional gambling as a business activity, the profits aren’t taxed.

When Betway winnings might become taxable

While most Betway players don’t need to worry, there are a few situations where winnings could fall into taxable territory. In my experience, these cases are rare, but they matter if you’re betting in a highly professional or structured way.

The CRA may treat your betting as taxable income if:

- You are gambling full-time with a clear system designed to generate consistent profits

- Your betting activity is organized like a business, with records, strategies, and tools that resemble professional income generation

For example, if someone treats Betway like their primary job, placing thousands of wagers with professional-level tracking, the CRA could argue that the profits count as business income. In that case, the earnings would be taxable.

Do you need to report Betway winnings on your taxes?

For the majority of Betway users, the answer is no. Recreational players don’t report winnings to the CRA, since they aren’t taxed. If your activity is casual and for entertainment, your Betway withdrawals are simply yours to keep.

That said, if your gambling activity even remotely resembles a business, it’s wise to speak to a tax professional. I’ve seen bettors underestimate how structured their play looks, only to face tough questions later.

What about withholding taxes at Betway?

Some players worry Betway might automatically deduct taxes on Canadian winnings. That doesn’t happen.

Unlike in the United States, where sportsbooks often issue tax forms and withhold a portion of big wins, Betway does not take Canadian tax off your payout. You receive the full amount you win.

The only deductions you might notice are related to payment provider fees—such as bank transfer or e-wallet charges—not taxes, though some players do report issues like a Betway deposit declined but money taken.

Tips for peace of mind when betting on Betway

From what I’ve seen, most Betway customers in Canada never run into tax problems.

Still, it helps to keep a few practices in mind:

- Stay recreational: Place bets for fun and entertainment, not as your primary source of income.

- Keep basic records: While not required, having a simple log of deposits and withdrawals can help if questions ever come up.

- Separate funds: Use a distinct e-wallet or bank account for betting activity. It keeps your finances cleaner and avoids confusion.

If your betting ever grows to the point where you’re treating it like a career, professional tax advice is a must.

Final thoughts on are Betway winnings taxable in Canada

To put it simply, Betway winnings are not taxable in Canada for recreational players. You can withdraw your money without worrying about deductions or CRA reporting.

The only time taxes might come into play is if you’re operating like a professional gambler or running betting as a business.

In my experience, most people using Betway fall firmly into the recreational category, which means their payouts are tax-free. That’s one of the perks of sports betting in Canada—you get to enjoy your wins in full.

FAQs

Are Betway winnings taxable in Canada?

For recreational players, Betway winnings are not taxable in Canada because casual gambling is treated as a game of chance, not business income.

Do I need to report Betway winnings to the CRA?

No, most Betway users do not need to report winnings to the Canada Revenue Agency unless their betting is run like a business.

Can Betway automatically deduct taxes from my winnings?

No, Betway does not withhold Canadian taxes from your payout. Any deductions you see are usually just payment provider fees.

When do Betway winnings become taxable in Canada?

Betway winnings may become taxable if you gamble full-time with a structured system that resembles business income.

Are Betway withdrawals in Canada completely tax free?

Yes, withdrawals are tax free for recreational players, allowing you to keep the full amount of your Betway payouts.